Amid a humid and occasionally torrentially rain-filled week in H-Town, we conducted a two-day listening tour, meeting with many clients and friends across the upstream/midstream/OFS/legal components of the energy complex. Our goal was to re-acclimate to the concept of an in-person meeting and listen to companies talk about the lay of the land (emerging ESG approach, balance sheet improvement, commodity price outlook, investor outreach) as they navigate this dramatic turn in the commodity price cycle. Key takeaways are below. Please reach out if you would like to talk in more detail. With little/no snow in the High Country, we’re reachable at all times in the next few days.

Takeaway 1: Houston traffic is back! Office space occupancy was higher than expected and highways were clogged with traffic. This represents a significant increase to what we currently see in Denver.

Takeaway 1: Houston traffic is back! Office space occupancy was higher than expected and highways were clogged with traffic. This represents a significant increase to what we currently see in Denver.

Takeaway 2: No new investors coming out of the woodwork yet. Each public company discussed the frustrations of not getting many inbound calls from high-quality potential shareholders. Some value investors are kicking tires now that energy companies are screening better on quant filters, but there is no broad pivot among the highly sought out plain vanilla crowd back into traditional energy. In fact, companies are having a difficult time doing outreach to long only asset managers because it’s difficult to find who (if anyone) still covers the sector within firms. Things are so quiet that one company lamented the lack of calls from the traditional long/short hedge fund community, whose footprint has dwindled dramatically.

In addition, companies highlighted the dramatic decrease in quantity and quality of sell-side equity research coverage. The old guard of analysts from the last cycle peak is largely gone, and seats have been sparsely filled with more junior analysts. Research coverage is down 30%-50% for companies that have not restructured, and down more dramatically for companies that have restructured. By and large, companies seem underwhelmed by “Gen 2” sell-side research analysts.

From our side of the table, we see that this market will require IR teams to be more proactive targeting new investors and that is something that takes real time, effort, and expertise. EnerCom shared some of its experience taking management teams on non-deal roadshows and insights from the 550+ one-on-one meeting requests we managed at our Conference last August.

Takeaway 3: Uncertainty on path forward for ESG/Sustainability reporting. ESG is top of mind for all public/private companies with whom we met. Management teams acknowledged the holistic linkage between “best practice” operations and strong ESG reporting. But the lack of a clear framework from the SEC on a path forward for ESG reporting is causing consternation among companies. The competing reporting standards (SASB, TCFD) are also a source of confusion.

Management teams know that at the very least, they have to “check the box” and provide disclosure to investors/regulators/stakeholders. But they are unsure how much disclosure to provide, and also unsure if reporting robust disclosures will drive stock outperformance, or merely limit the stock from being filtered out of ESG indices. Growth-oriented companies are concerned about the impact that buying assets that could negatively impact their ESG reporting.

Our conversations also confirmed how focused private companies are on ESG reporting. The drivers appear to be a combination of IPO readiness, being able to report findings to LP investors, and demonstrating strong environmental stewardship in their area(s) of operation.

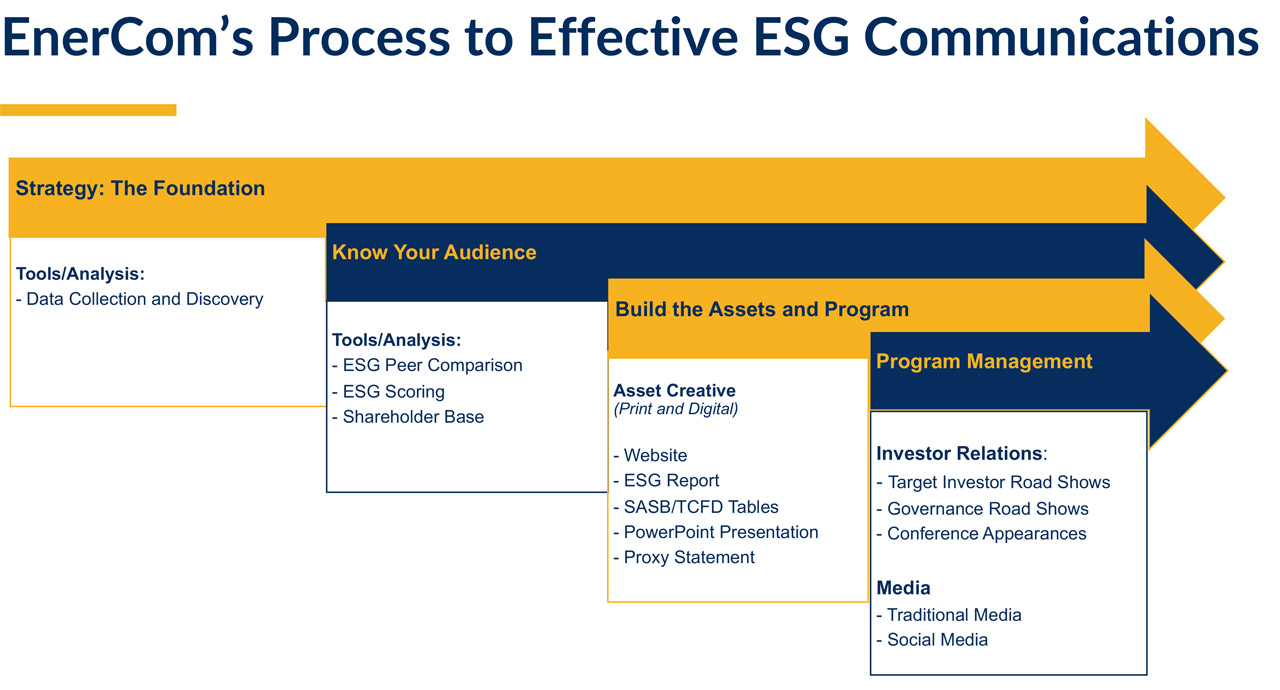

Our policy on ESG continues to be that small, growing companies do not have the same reporting requirements as larger peers, and should be comfortable disclosing metrics most commonly reported by their peers. ESG is a journey. Companies need to start moving down the path. They can walk before they run. And EnerCom can help.

Takeaway 4: Lending syndicate evolution creates opportunities and challenges for companies and capital providers. After the commodity price volatility seen in 2016 in 2020, as well as the increasing pushback from many bank shareholders to banks to cease lending to fossil fuels companies, we would not have been surprised to see a more dramatic exodus of banks from the RBL business. But our discussions suggest the environment appears more benign than expected. Several companies mentioned the departure of some international banks from their RBLs, amid a concurrent increase in participation from middle market US banks.

We are also hearing from companies and private lenders about the emergence of private equity debt into the RBL syndicate. While this is a higher cost of capital, it shows the evolution of the business. Alternate capital providers are seeing opportunity to support lower quality companies that may be poised to improve their financial/operational standing.

In addition, we heard about more interesting requests from lending banks in the syndicate. Some are agreeing to participate, while requesting the companies draw a portion of their line to support banks’ loan growth objectives. And banks are bidding more aggressively to provide commodity hedging services, traditionally seen as an afterthought business. In an environment where there is little/no equity or debt capital markets activity, structuring hedge books is one of the few low-risk ancillary business lines available to the banks.

Takeaway 5: Companies happy to hedge into 2023 at strip pricing. Some companies acknowledged the perverse benefits of recognizing MTM hedge losses, given these losses imply commodity prices have strengthened. And while being fully unhedged implies full exposure to a much more attractive futures strip (NYMEX WTI at $77/$70 and NYMEX HHUB at $4.50/$3.60 in ‘22/’23), companies are happy to take what the market is giving them into 2023, especially with collars that provide a bit more upside.