By Tim Rezvan, CFA

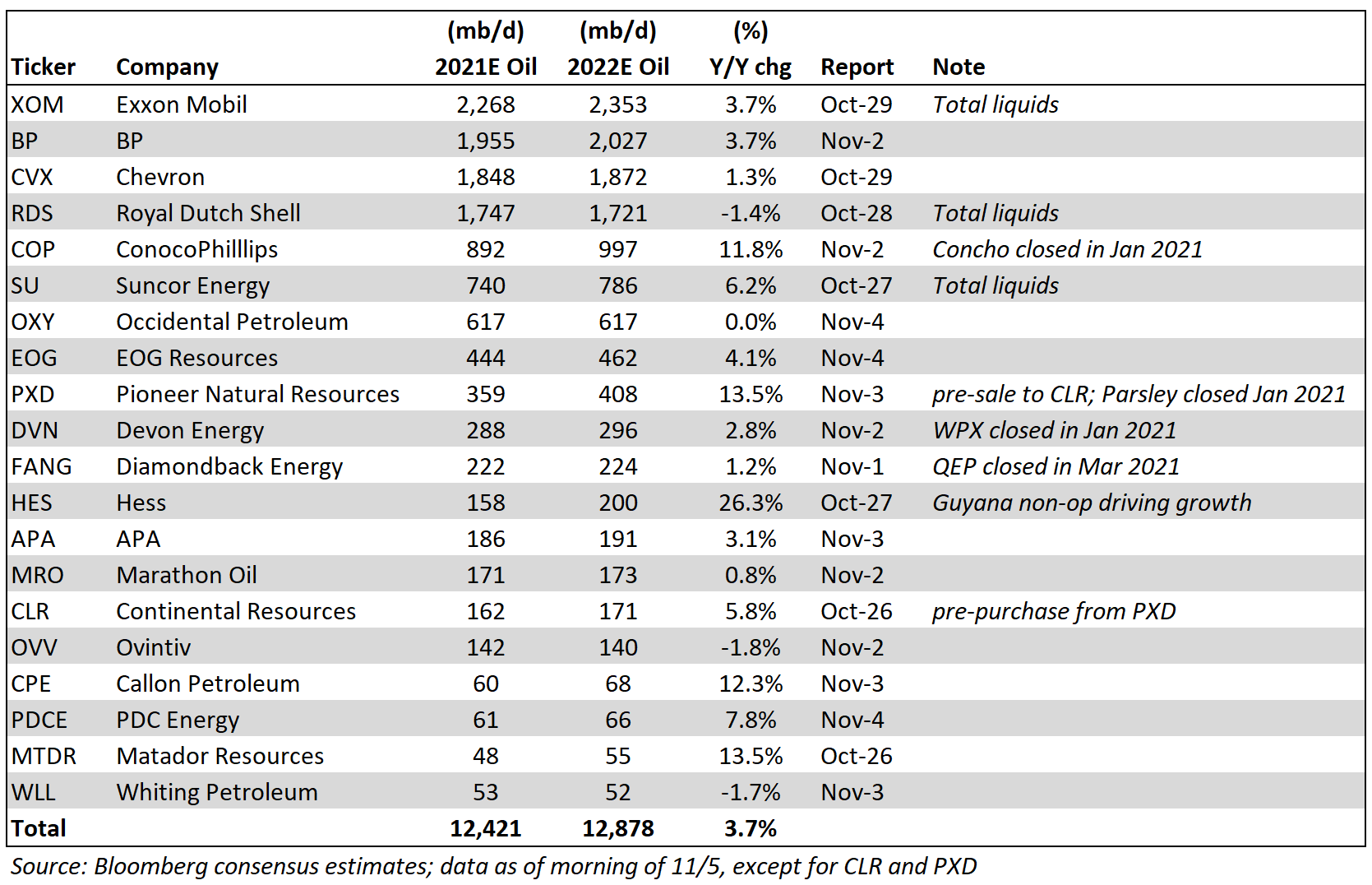

With 3Q earnings season in the rear-view mirror for the large liquids-focused producers, we wanted to quantify management teams’ comments about holding the line on production growth in 2022. We looked at 20 large integrated and upstream companies to assess the 2022 production growth outlook. To do so, we used Bloomberg consensus figures, as of the morning of 11/5 and figures from earlier this week for Pioneer Natural Resources and Continental Resources, given noise in production forecasts for the previously announced Delaware Basin.

The quantitative results confirm the qualitative comments we heard across the board about prioritizing capital return over production growth. In total, the production growth outlook for this group of 20 is only 3.7%.

We note some limitations of this work. For Exxon Mobil, Royal Dutch Shell and Suncor, we are reporting total liquids, and have not received formal 2022 guidance from most of these companies. That said, the collective hive mind of the sell-side community has baked in cautious commentary from the C-suite and sees modest y/y growth.

With WTI hovering around $80+ and the 2022 WTI strip at $73/b, balance sheets are strengthening across the oil patch. The ability to fund additional growth without driving higher leverage is easier than it’s been since 2018. But we see no signs of that scenario playing out in 2022, even as global demand is expected to increase as the world reopens. The path of least resistance for crude appears to be higher.

Some relevant comments on 2022 heard on Q3’21 earnings calls:

“Directionally, we don’t anticipate a significant departure on capex from what we included in our June update excluding Shell. In June, we provided an outlook based on a roughly $50 per barrel price that included a modest ramp in the Lower 48 to reactivate our optimized plateau plans, some incremental base Alaska investment and some longer-cycle low cost of supply investments in Canada, the Montney and in Norway. Since June, we see some inflation pressures, especially in the Lower 48. However, at this point, we’d expect to adjust scope modestly in order – in response to maintain our base capital at a level that is roughly consistent with our June update.”

—Ryan Lance, Chairman and Chief Executive Officer of ConocoPhillips

“…as long as our balance sheet stays in great shape, which we expect, and commodity prices continue to stay strong, we’ll continue to look at increases over and above our growth rate of 5%. Again, the variable dividend, up to 75% of previous quarter’s free cash flow of deducting the base dividend. We’ll be distributing about 80% of free cash flow back to the shareholders.”

—Scott D. Sheffield, Chief Executive Officer of Pioneer Natural Resources

“Our commitment to capital discipline will not waver with maintenance oil production, the case to beat, as we finalize our 2022 budget. We believe the right business model for a mature industry prioritizes sustainable free cash flow, a low reinvestment rate and meaningful returns to equity investors.”

—Lee Tillman, Chairman, President, and Chief Executive Officer of Marathon Oil

“So, starting last month and until we reach $3 billion of net debt, we’ve committed to return 25% of the previous quarter’s free cash flow after base dividends to our shareholders through either share buybacks or variable dividends. When we consider the total dollars involved, at the 25% level, this level of cash returns is very competitive with our peers. The remaining 75% will be allocated to the balance sheet with a modest amount allocated to small low-cost property bolt-ons. Once we hit our net debt target which at today’s prices could be as soon as year-end 2022, we plan to increase the shareholder return allocation to at least 50%. Our plan is underpinned by a reinvestment ratio of no more than 75% of cash flow, and in 2021, we’ll reinvest less than 50%.”

—Brendan McCracken, President of Ovintiv